Context

Fixed-Mobile Convergence (FMC) – owing to several benefits including significant cost synergies, revenue uplift and improved customer loyalty – is becoming increasingly popular in emerging markets, following success stories in developed countries.

In developed markets, early adopters to FMC (e.g. Vodafone, Orange, BT, AT&T, Rogers and Telefonica), have established their presence in several aspects of the telecom value chain.

These operators have availed numerous benefits including cost synergies (IP transit, OPEX improvements, backhauling efficiencies), increases in revenue, improved customer retention (up to 75% reduction in churn), which have given them a sustainable competitive advantage.

Most of the early adopters organically approached FMC by building their own fixed / mobile networks as their conventional business gained momentum, since they were then operating in a relatively less competitive market. However, as telecom markets became more fragmented, many telecom operators found it easier to adopt an ‘inorganic’ strategy in order to implement convergence.

Emerging markets vs. developed markets

The emerging markets, as discussed here, include high-growth, developing economies such as Eastern Europe, Middle East, Africa, CIS and Asia; and exclude relatively affluent (resource-based) economies with relatively mature telecom sectors, such as those in South East Asia and the Gulf (GCC).

Certain characteristics and market dynamics differentiate these emerging markets from developed markets (as outlined below):

- Demographic growth: Emerging markets typically have fast-growing and relatively young populations, which drive a sizeable untapped addressable market for broadband services.

- Lack of wholesale regulations: Wholesale / network sharing regulations in many of these markets either do not exist or are in the initial stages of policy-making. Consequently, infrastructure sharing exists between operators on an opportunistic basis only (more common in mobile than in fixed line).

- Primarily mobile markets with prepaid dominance and high churn: Majority of the value in the telecom market in these countries is in the mobile space. A significant part of the mobile customer base remains prepaid in many of these markets (which warrants high churn). As a result, retention has become a key motive for FMC.

- Incumbents with basic / poor fixed infrastructure: Incumbent operators often have the widest fixed infrastructure coverage (nationwide, in some cases) but with obsolete quality (e.g. PSTN, copper, DSL).

- Challenges in obtaining permits: Due to lack of transparency in certain markets, it becomes challenging for operators to obtain rollout permits (e.g. Right of Ways, Spectrum). As a result, these permits become a commodity and often a driver of M&A.

- Limited talent, especially related to advanced technologies: Emerging markets are behind the technology curve, especially when it comes to fixed infrastructure (e.g. FTTx) and its associated value proposition. As a result, the required talent to drive this change is also scarce in most markets.

Recent FMC in emerging markets

As in developed markets, FMC has become increasingly important in emerging markets. Increased competition and high data consumption have led to flattening revenue, suppressed margins, higher cost to serve (especially data), whilst offering similar levels of network investment. In addition to the benefits of FMC outlined for developed markets, there are certain needs in emerging markets that are also addressed by FMC.

Mobile operators in emerging markets have the desire to establish a fixed network in order to get reliable access to fibre backhaul for their mobile broadband proposition (over 3G and 4G) as well as to expand their business offering. These networks can then be further expanded to reach customer premises.

Many emerging market mobile operators organically approached convergence as there have not been enough fixed assets available in the market other than state-owned incumbents. However, acquisitions / attempted-acquisitions are quickly becoming a popular trend, especially as single / dual-play broadband operators emerge.

It has also been common for fixed line operators (especially state-owned incumbents) to launch their own mobile operators to expand revenue streams as customers begin substituting fixed line for mobile. However, as emerging telecom markets became more fragmented (due to several mobile license / frequency tenders), fixed line operators have managed to find easy acquisition targets in often struggling mobile challengers.

Impact on performance and returns

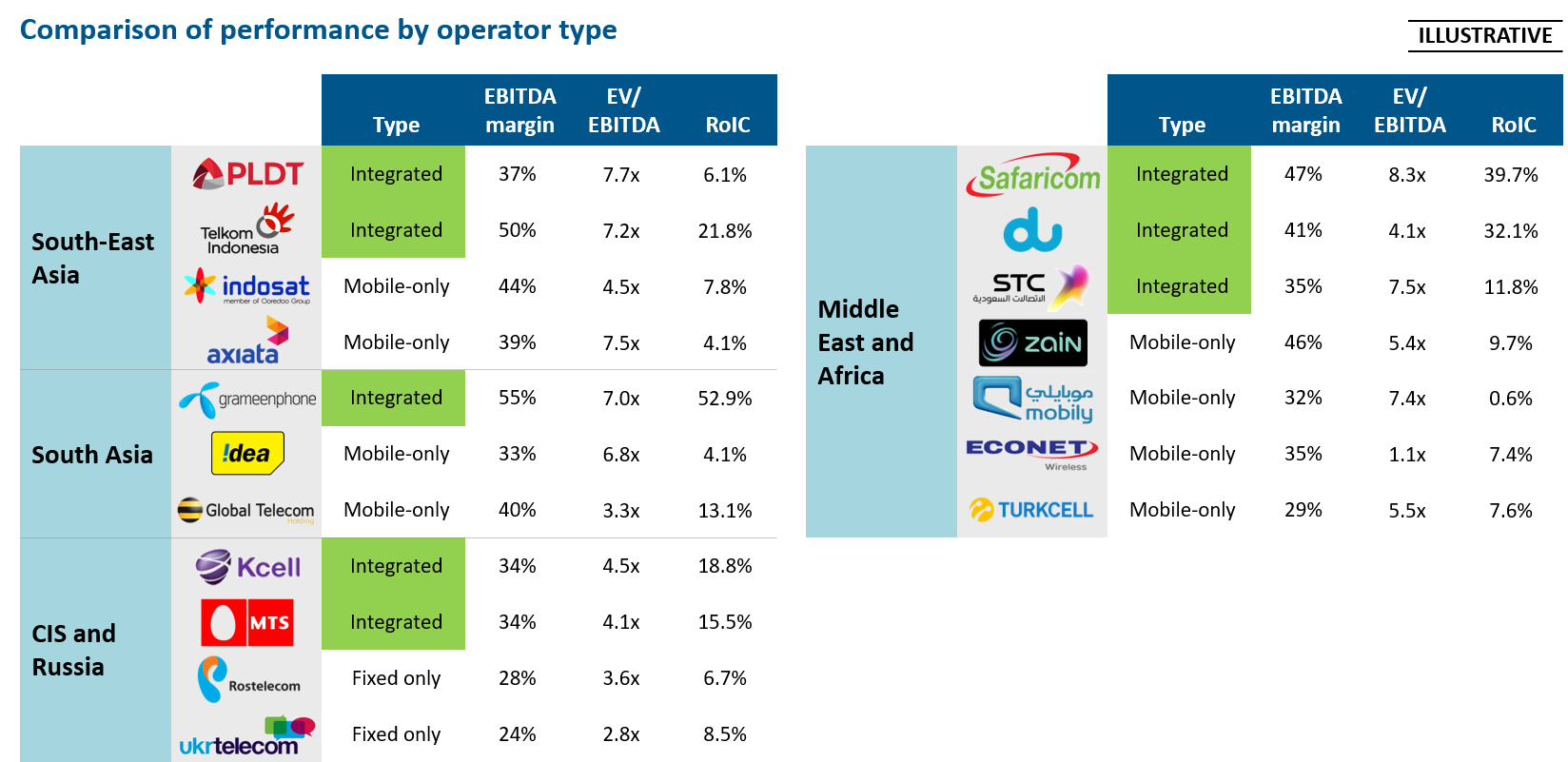

In addition to significant impacts on operating performance (ARPU uplift, churn reduction, etc.), convergence results in a distinct effect on the financial performance of telecom operators. Like-for-like comparables are not always available since not all operators are listed. The Exhibit below shows comparison of EBITDA margins, EV / EBITDA (valuation multiple) and return on invested capital for selected operators per region.

In general, integrated operators outperform standalone operators in all of the said financial metrics. Market specific or operator specific circumstances may not allow for clear comparisons within regions.

Potential risk associated

While converged offerings come with several advantages, it is important to be weary of potential risks

- Bundling discounts: Operators typically offer discounts (c.10-40%) on bundled fixed-mobile products to drive adoption in the short term. If multiple operators adopt convergence in the market at the same time, this may result in a price war, negating the FMC value upside in the short term.

- FMC overcrowding: In certain markets, operators may adopt FMC to replicate a competitor’s strategy, without assessing market demand. In the absence of wholesale regulations, it may not make financial sense for all operators to invest into fixed-line infrastructure.

- Lack of expertise and overspending: It is often challenging to find the right management expertise to implement an effective FMC strategy. Standalone mobile and fixed players often tend to embark on their traditional management to deploy this strategy with limited experience of the new business (fixed or mobile). This, in many cases, has resulted in overspending on CAPEX, organisational inefficiency, slower time to market and inability to fully realise synergies

Best path to implementation – Organic vs. Inorganic

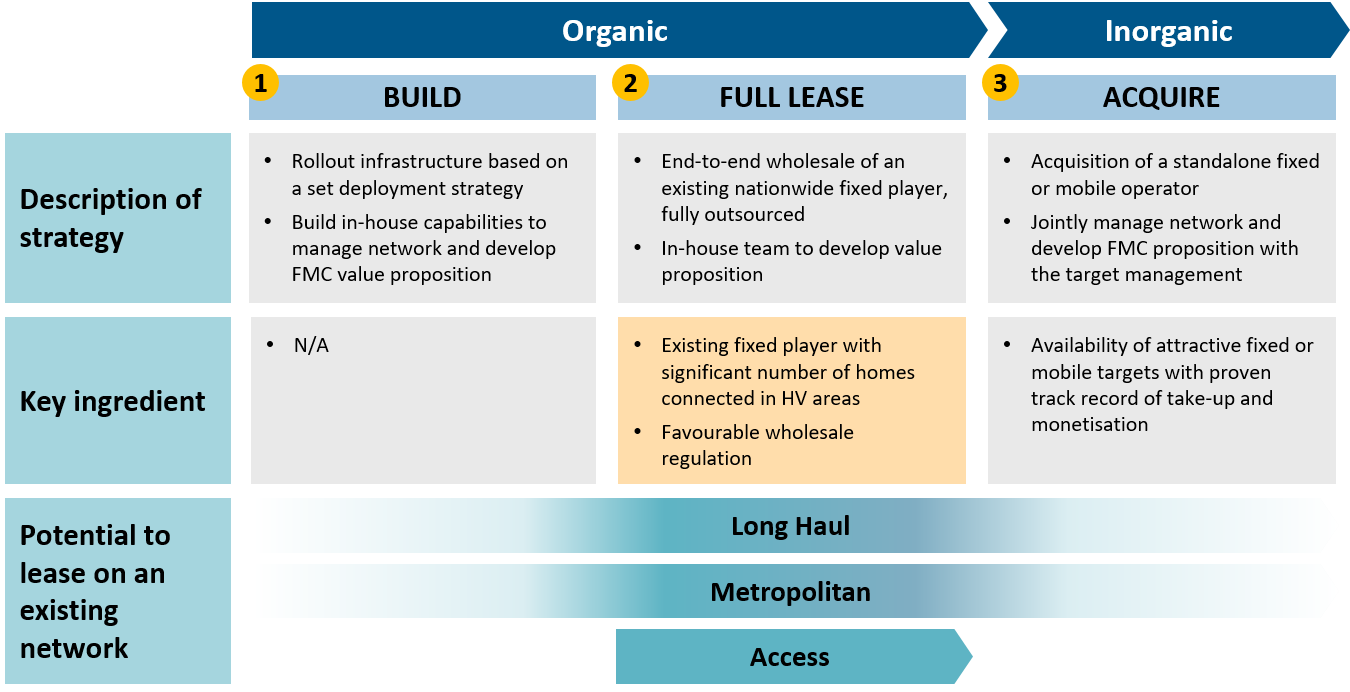

FMC implementation can broadly be categorised into three paths that are typically considered by operators:

Build and Acquire are the most typical options assessed by operators. The full lease / wholesale option exists only in certain markets where a wholesale network (nationwide fixed or mobile network connecting a sufficient set of subscribers) exists and favourable regulations push such an operator to share its network at commercially viable rates. Despite this, partial leasing of network (at least Long Haul and Metro) exists opportunistically even in the Build and Acquire options.

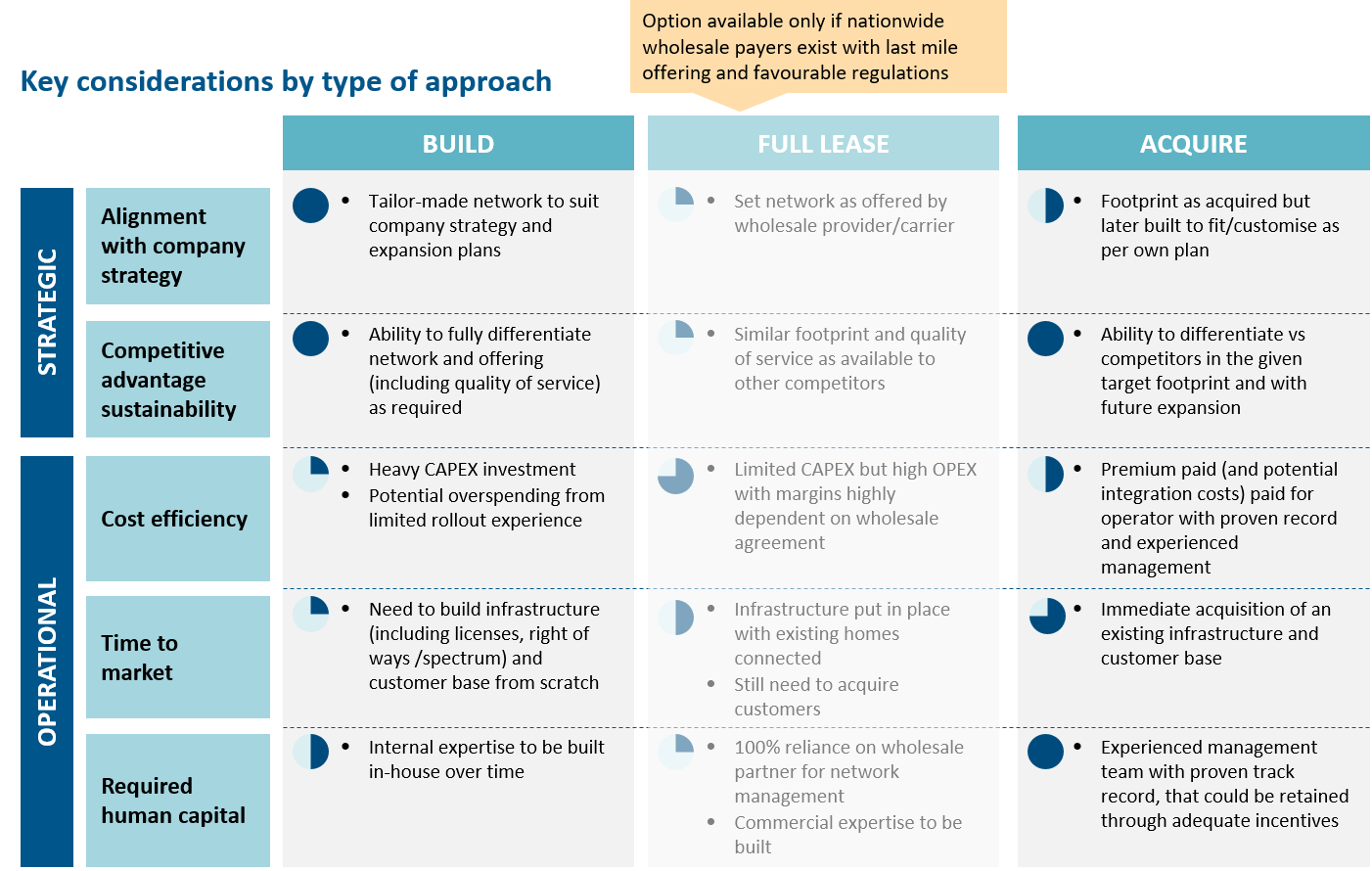

Multiple strategic, commercial, technical and financial aspects need to be considered in order to adequately assess the organic vs. inorganic FMC options. Obviously, each market has its own limitations and opportunities, but the Exhibit below assesses the most pertinent considerations.

Generally, organic FMC has become less favourable in emerging markets today. Due to the lack of experience and talent with standalone operators to run and maintain technologically advanced networks (e.g. FTTx) efficiently, there have been many unsuccessful organic FMC attempts. Obtaining Right-of-Ways and Spectrum has been another big challenge where, either due to high competition or lack of transparency, it has become challenging to roll out a new network with the desired quality of service.

This is where inorganic FMC has triumphed. It not only enables quick time to market, but also brings forth a business with a proven track record and management. While integrations of businesses could be challenging, it can be phased out over a period of time so as to avoid disruption to business and market shocks. Meanwhile, the two businesses can still avail several cost synergies as well as revenue synergies via cross-selling.

Operators tend to be more inclined towards building their own business organically as a default approach. However, given unfavourable trends (e.g. flattening or declining revenue, suppressing margins, declining RoIC) related to traditional mobile or fixed line businesses in isolation, operators should re-evaluate the time and resources required for organic deployment of new strategies such as FMC. In doing so, telecom operators in emerging markets will be able to embrace the benefits of FMC and ultimately accelerate their growth.

Source: https://www.deltapartnersgroup.com/fixed-mobile-convergence-emerging-markets-%E2%80%93-organic-vs-inorganic