There is a broad consensus that Europe needs more high speed broadband networks. European telecom CEOs recently wrote a note urging European leaders to revise the European Electronic Communication Code and stick to the original spirit of Europe’s Gigabit Society plans by incentivizing investment-based competition. This has worked well in Spain, as some articles in the Spanish press have pointed out.

Spain is indeed different when it comes to the deployment of ultra-fast broadband networks. In a relatively short period, the country’s telecom operators have laid out fibre-optic cables reaching 31 million premises – more than France, Germany, the UK and Italy combined. In the OECD, only Korea and Japan have more.

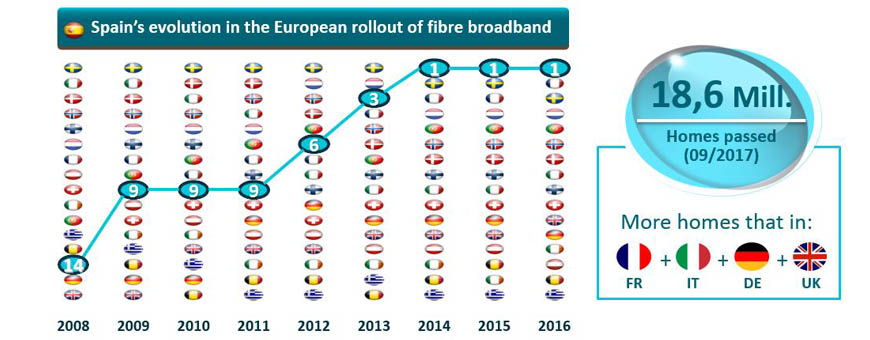

Spain has been the fastest country to develop a fibre-to-the-home technology (FTTH) network in Europe, thanks to the right competitive and regulatory conditions. By 2016, about 63% of Spanish households had access to ultra-fast broadband.

Telecom regulators and European governments want to encourage more fibre rollout, and for good reason. Fibre-optic cables have many advantages over their older copper cousins. They can transmit more data faster and over longer distances without losing the signal, a particular advantage for television. A faster network enables telecom operators to meet the sky-rocketing demand for bandwidth. Telefonica has become a data-driven company, billing more in broadband and connectivity services than voice and access.

High in fibre

Back in 2008, Spain was a laggard in Europe in terms of homes passed with FTTH technology. But by 2014, it had jumped to number one in Europe. Investing billions of euros in state-of the art fibre networks during the financial crisis was not an obvious choice for Telefónica or its peers. The recession cut the country’s GDP by nearly a tenth between 2008 and 2013 and over a quarter of the workforce was looking for a job.

Several factors made Spain particularly ripe for the deployment of ultra-fast broadband networks. Faced with an increasingly competitive broadband market, Telefónica decided to invest in fibre to transform its services.

Operators had access to the high quality civil infrastructure necessary to connect fibre to the home. This included manholes, ducts, poles and access to buildings, as well as an obligation for landlords to provide access to the in-building fiber infrastructure. The availability of this infrastructure – provided by Telefonica – was a key differentiator in Spain.

Spanish regulation also promoted investment and competition, creating incentives for operators to roll out fibre networks. Telefonica was not obliged to allow other providers access to our network at speeds above 30 megabits per second, and that meant that other operators rolled out their own networks in order to compete for ultra-broadband services.

Telefónica launched “Movistar Fusión” and pioneered the so-called “quad-play” in Europe – a discounted bundle of mobile, fixed, broadband and television, in September 2012. The strategic bet on fibre has paid off for Telefónica: Movistar Fusión attracted new customers and encouraged existing ones to buy more services.

Other competitors soon followed in a flurry of investment, and later, consolidation. In 2013, Jazztel reached an agreement to roll out fibre jointly with Telefónica. Vodafone and Orange began investing in their own fibre networks. Vodafone eventually bought cable operator Ono, and Orange purchased Jazztel.

What’s next?

By September 2017, Telefónica had passed 18.6 million premises with fibre in Spain, making it the biggest FTTH network in Europe. New regulation may well lead to a slowdown in the network expansion. In some cases, it makes sense for telecom operators to reduce the risk associated with network rollout through co-investment or commercial network sharing agreements. In places where there is no competitive advantage from owning the infrastructure, risk sharing mechanisms can help accelerate network rollout.

For example, Telefonica recently reached a commercial wholesale agreement with Vodafone in Spain. Through this deal, Vodafone will be able to access Telefónica’s fibre, not only in certain municipalities that are subject to regulation, but also in others where Telefónica does not have wholesale fibre access obligations.

This market-based approach could be applied elsewhere and help inform the current debate on the European Electronic Communications Code, which aims to encourage investment in superfast networks. Europe has lost the technology edge it had in the 1990s, and is at risk of falling further behind the latest wave, which could soon see billions of new smart devices connected to the internet. Having future-proof networks will be key.

Source: https://www.telefonica.com/en/web/public-policy/blog/article/-/blogs/why-spain-is-a-case-study-for-super-fast-broadband