What is Capital Expenditure?

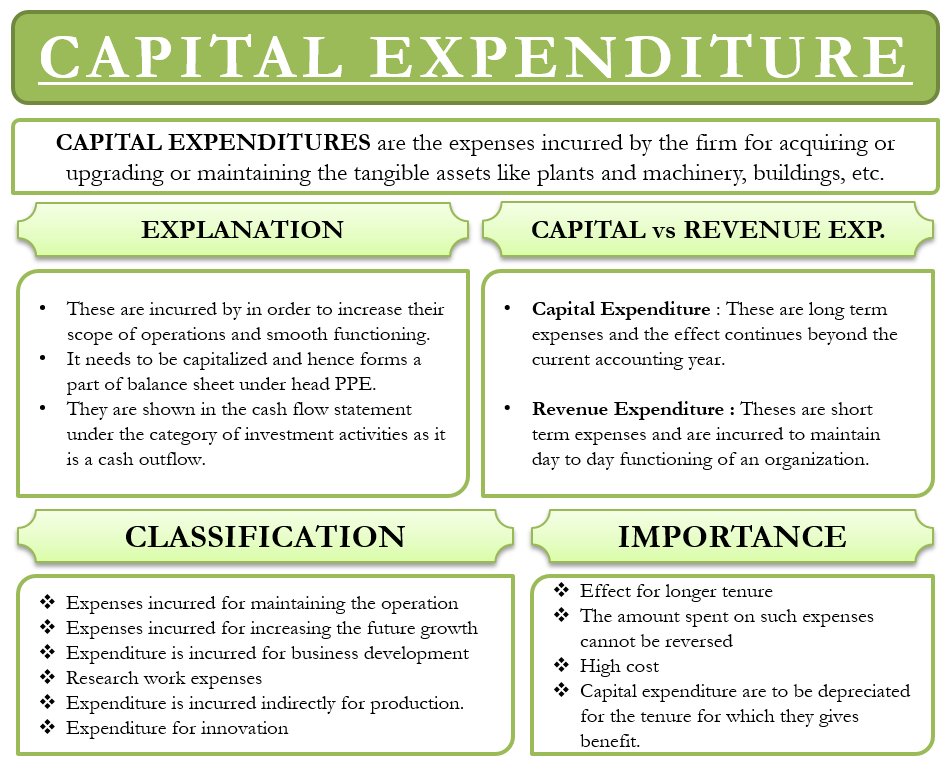

Capital expenditures are the expenses which the firm incurs for acquiring or upgrading or maintaining the tangible assets like plants and machinery, buildings, other types of equipment required for the firm. They are also known as CapEx.

It includes the undertaking of novel projects or any important long term investments. It includes a huge gamut of expenditures staring from repairing a building or purchasing any fixed asset and related expenses. The company incurs these expenses in order to increase its scope of operations and smooth functioning of the organization. In short, expenditures which the firm incurs forming a part of the balance sheet rather than income statements are referred to as capital expenditures.

Capitalization of the expenditure

The firm has to capitalize the capital expenditures. The company capitalizes the expenditure by spreading the total cost throughout the useful life of the asset. But the expenses incurred for maintaining the asset and sustaining the current position can be deducted in total in the same year.

They show these capital expenditures in a different way in different financial records. They are shown in the cash flow statement under the category of investment activities as it is a cash outflow for that particular accounting year. It is shown as expenses incurred like purchases of property, plant, and equipment (PP&E), etc. They are recorded on the balance sheet as an asset under the heading of “property, plant & equipment.”

Capital expenditures include expenses like:

- Plant and equipment purchases

- Building expansion and improvements

- Hardware purchases, such as computers

- Vehicles to transport goods

The requirement of capital expenditure depends on the type of industry. It varies from industry to industry. A capital intensive business requires more capital expenditure while a non-capital intensive business incurs more operating expenses. Every year the asset gets depreciate till the end of the useful life of that asset. Depreciation represents the wear and tear on that asset.

Capital Expenditures vs. Operating Expenses

The expenses are bifurcated into two types: CAPEX (Capital Expenditure) and OPEX (Operating Expenses)

Capital Expenditure

Capital expenditures are long term expenses and the effect continues beyond the current accounting year. It basically includes expenses incurred to buy fixed assets or any investment made that has a life of more than one year. It also includes expenses incurred to improve the working life of any assets or equipment.

Operating Expenses

Expenses incurred to maintain day to day functioning of an organization. They are usually short term expenses necessary to meet the operational cost of running a business. The tenure for such expenses is less than one year and the firm accounts them in the same year in which they incur.

What does it Explain?

It explains the amount spent on long term assets shown in the balance sheet. Long-term assets are usually physical, fixed and non-consumable assets like property, equipment, or infrastructure. They have a useful life of more than one accounting period. It also explains the expenses incurred to purchase, for improvement, or maintenance of long-term assets to enhance the efficiency or capacity of the company.

Classification of Capital Expenditures

The capital expenditure may be classified into the following categories.

- Expenses incurred for maintaining the operation of the company such as replacement of old machinery by a new one.

- Expenses that the company incur for increasing future growth like buy of new plant and machinery to enhance the market potentials.

- Business development expenses such as exploration of a new market, advertisement, etc.

- Research work expenses.

- Expenditure which the company incurs indirectly for production.

- Expenditure for innovation.

Capital expenditure can be either tangible or intangible. Tangible includes machinery purchase, plant or equipment while intangible includes expenses for patents or trademarks. It is most important to note that the expenses that the company incurs for repairing the asset or maintenance of asset do not form a part of capital expenditure. They are shown in the income statement whenever it is incurred.

Importance of Capital Expenditures

Capital expenditures are quite vital for a business. They directly help in increasing and maintaining the growth of a business. Besides they are important for the following reasons.

- Effect for a Longer Tenure: The expenses incurred under the category of capital expenditure usually have effect for more than the current accounting year in which they have been incurred. The benefits extend for more than one year.

- Irreversible Capital Expenditure: The amount spent as capital expenditures are such that they are difficult to reverse

- High Cost: Capital expenditures are more expensive and involve a huge cost. Therefore it is very important to incur them wisely.

- Depreciation: The company has to depreciate the capital expenditures for the tenure for which they give a benefit.

Example

The following are examples of capital expenditure

- Buying a tangible or intangible asset

- The expenses incurred to expand the capacity

- Expense incurred to make a non-functioning asset usable

- Repairing the asset to use it again

- When the acquisition of a new business

Conclusion

Thus, capital expenditures are the long term expenses that a firm incurs to buy, to improve or extend fixed assets. Its effects continue for one year or more. Since a substantial amount is involved in capital expenditure it becomes very important to manage such expenses very wisely.

(Source: efinancemanagement.com)