Buy, grow and knock out the competition – and now share. Some markets are moving beyond growth and hypercompetition to collaborative consumption via digital platforms. What makes these new models different? Why are some succeeding? And what can they teach us? In this blog we compare the conventional taxi operator model with Uber’s pioneering new approach.

Share, share and spread it around

Holiday apartment platform Airbnb and transport network Uber are at the vanguard of the sharing economy. Basically they’re nothing new: bartering began long before the digital revolution, the practice of renting out rooms for a small consideration was common back in the Middle Ages, and noticeboards for people seeking or offering lifts have been around for decades. But it’s only with the advent of digital platforms that this has all been possible on a large scale, turning markets into mass markets.

A model with a certain extra something

Journalists have taken to labelling promising new startups taking on established markets as ‘the new Uber’. Uber is the epitome of the sharing economy. By simplifying the interface between people offering rides and those looking for them, it’s sending waves of trepidation through the world of established taxi operators. In many places – for example New York and cities in Germany – traditional players are having to resort to legal action to defend their turf, in some cases successfully. It all begs the question of what makes Uber’s approach so superior to the conventional model.

Flexible key resources

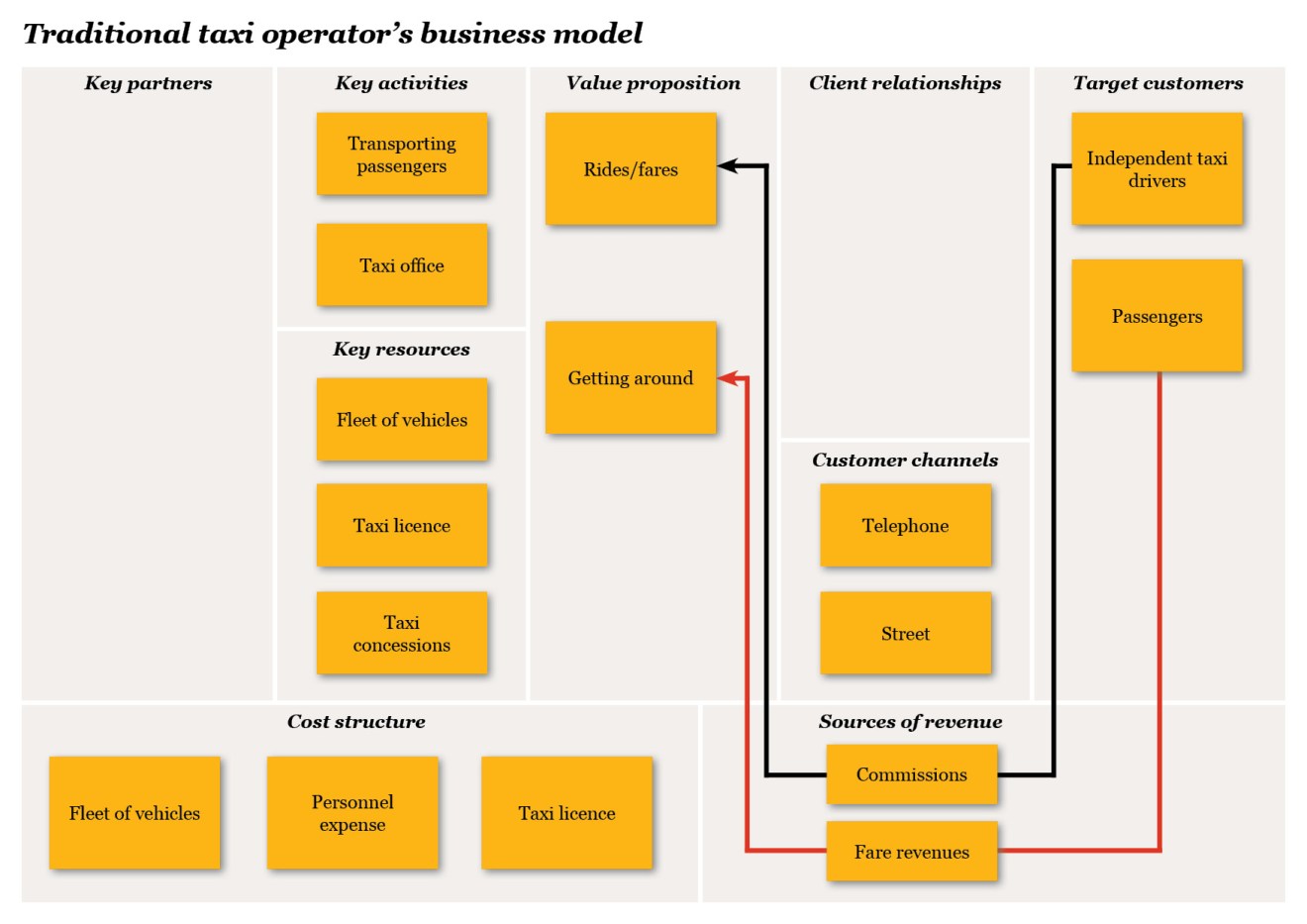

At first glance there doesn’t appear to be that much difference between Uber and traditional taxi companies. They all get passengers from A to B. But Uber takes a radical new approach to key resources and the channels used to reach customers.

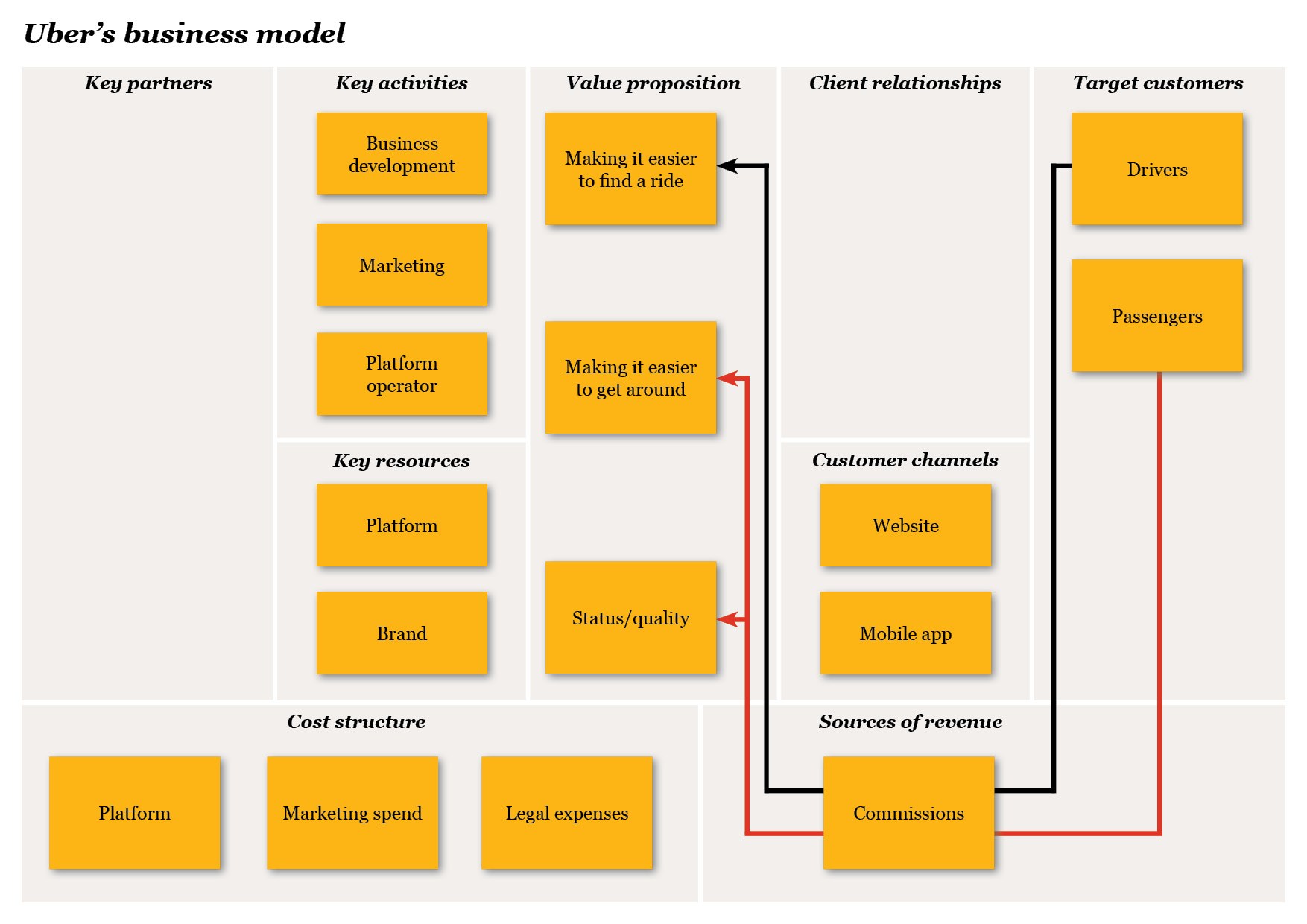

Uber’s business model.

Flexible key resources

By key resources we mean all the means (which are in scarce supply) used to profitably produce or enrich an offering, for example talented staff, rare minerals, unique brand appeal, etc. Most established taxi firms have a large fleet of vehicles and taxi licences that have to be obtained from the towns and cities where they operate. The supply of licences is strictly limited to prevent the competition from getting too intense and putting too much pressure on wages. At the same time it makes it almost impossible for taxi operators to expand into other towns and cities.

Uber, by contrast, doesn’t have a fleet of its own, never mind its own drivers. Its key resource is its digital platform, the virtual marketplace where independent drivers can connect with passengers seeking a ride. Uber lays down the rules for these business relationships (type of vehicles permitted, prices, payment and ratings). To expand into new cities Uber hasn’t had to build a fleet or recruit new drivers. It’s been able to roll out its platform in new locations easily at fairly minimal personnel expense. This has enabled it to expand across the planet with almost unprecedented speed and aggression.

Connected customer channels

Customer channels are what connects offers with customers. They include all distribution and communication channels through which the customer finds out about or acquires the product or service. In the taxi business a passenger is looking for a taxi. If there’s no taxi available nearby they have to call the taxi office and wait a while. Not with Uber. You don’t have to know a whole bunch of phone numbers by heart. Once the Uber app’s installed on your smartphone you’re only a few clicks away from your ride. The app locates you automatically by GPS and connects the driver and passenger immediately. Less far for the driver to travel, less time for the passenger to wait.

In a nutshell

At the core of every business model is the utility a customer enjoys by virtue of acquiring the product or service. Both Uber and conventional taxi operators enable passengers to get from A to B. But Uber’s model differs fundamentally from the traditional set-up in terms of the way it harnesses key resources and customer channels to optimise the utility for both passengers and drivers. The app minimises the effort to order a taxi and the time passengers have to wait. And it makes it easier for drivers to get fares – so much so that even private individuals are getting on board and offering their services as paid drivers.

It is this type of disruption of existing business models that is transforming many industries, and Uber and other similar platforms are prompting many businesses to re-examine their own business models and try to ‘disrupt themselves’ from within rather than waiting to be disrupted.

Source: https://news.pwc.ch/36434/ubers-business-model-goes-overdrive/